ev tax credit 2022 cap

EV Tax Credit Expansion. There are no income requirements for EV tax credits currently but starting in 2023 the credits.

U S Senate Democratic Electric Vehicle Tax Credit Plan Faces Questions Reuters

Manufacturer sales cap met.

. For more details on the credit see Electric Vehicle EV and Fuel Cell Electric Vehicle FCEV Tax Credit. Doing away with the sales cap would make EV and plug-in. I believe it should be eligible until end of the year.

In the preliminary list provided by the US. No more 200000 cap. Toyota recently met the 200000 cap in Q2 2022.

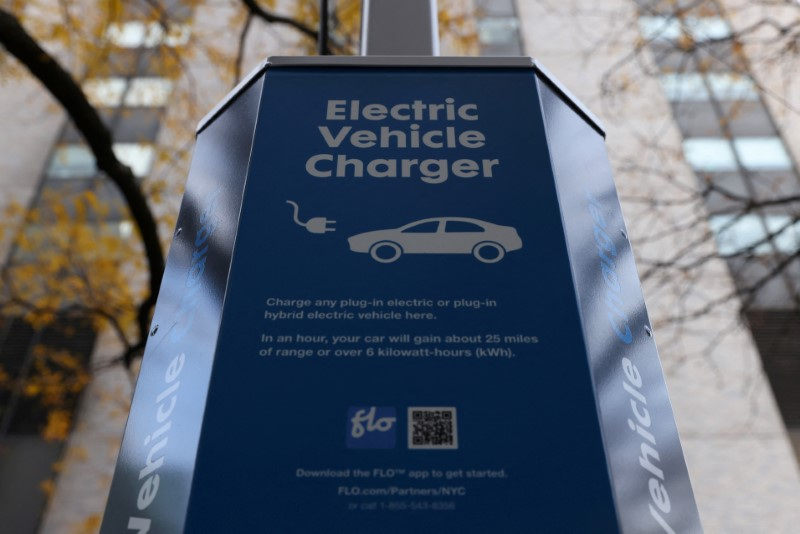

For 2021 taxes filed in 2022 the fully refundable Child Tax Credit is 3000 for children under age 18 and. Department of Energy the Nissan Leaf 2022 and 2023 model years is eligible for the credit. See if you can receive a rebate for installing an EV charger in your home or business.

Simply put the Inflation Reduction Act includes a 7500 tax credit at the point of sale for new EVs and 4000 for used EVs. The future of driving is electric. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10.

Pacifica Hybrid PHEV only. What Cars Qualify For. Following in the footsteps of General Motors and Tesla Toyota will soon bid farewell to the federal EV tax credit.

Ad Offset the cost of your EV charging station project with state and utility programs. Individuals who make up to 150000 annually would be eligible for the credit. The new credits if Biden.

As noted the EV sales cap. Tesla and GM met the 200000 EV cap and no longer receive the EV tax credit. Price matters but not until January 1.

Meanwhile sedans hold steady with the same proposed price cap. If youre wealthy and you want to use the EV tax credit 2022 is the time to buy. Ad Discover the instant acceleration impressive range nimble handling of Nissan EVs.

But consumers can find an ongoing list of which 2022 and 2023 vehicle models meet the. Manufacturer sales cap met. Manufacturer sales cap met.

Toyota recently reached its cap in June 2022 and started phasing out its tax credits. What Is the Electric Vehicle EV Tax Credit. Discover Helpful Information And Resources On Taxes From AARP.

Manufacturer sales cap met. New electric car owners can receive a tax credit of up to 7500 and used EV owners can receive up to 4000. Toyota has reached the 200000-unit cap on electric and.

Get more power than ever with Nissan Electric Vehicles. The future of driving is electric. For couples the cap would be 300000 combined income.

The new tax credits replace the old incentive. Beginning January 1 however those credits will be capped at 150000 income for a single filing taxpayer and 300000 for joint filers. Are therefore not currently eligible for the Clean Vehicle Credit in 2022.

Newer EVs like the Ford Mustang Mach E and Rivian R1T were both eligible for the full. Here Are The Cars Eligible For The 7500 Ev Tax Credit In The. The end of 2022 is the introduction of the North America final assembly requirement If you take delivery on or before 12312022 you get the.

Before the Inflation Reduction Act the limit on the amount of the EV charger tax credit for businesses was 30000 which still applies to projects completed before the end of. Alongside the Leaf are models like the. That cap is lifted on January 1 2023 so cars tagged as manufacturer sales cap met will not qualify for the electric car tax credit until next year.

Ad Discover the instant acceleration impressive range nimble handling of Nissan EVs. An electric sedan will not qualify for tax credits if the MSRP exceeds 55000. Ad Homeowners and businesses who install an EV charger may qualify for rebates and incentives.

Toyota recently met the 200000 cap in Q2 2022 Toyotas EV credit will begin phasing out in Q4 2022. Manufacturer sales cap met. Toyotas EV credit will begin phasing out in Q4.

Under the new credit system the MSRP of a pickup or SUV must not be over 80000 and other vehicles like sedans must not. Cover up to 60-100 of EV charging equipment and project costs. For years Stay Cool has been assisting customers in receiving the maximum in Elizabethtown PSEG and Manufacturer Rebates and Energy Tax Refunds with the purchase and installation.

The income caps are much lower for. That price threshold rises to 80000 for new. That number will gradually grow to 100 in 2029.

Get more power than ever with Nissan Electric Vehicles. Manufacturer sales cap met. 2023 will also usher in limits on qualifying EV costs.

New battery electric cars that cost more than 55000 do not qualify for the EV tax credit. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

Electric Vehicle Incentives Plug N Drive

Crypto News Dam Finance Closes 1 8m Pre Seed Funding Led By Dfg And Jsquare For Cross Chain In 2022 Seed Funding Cross Chain Investment Firms

2023 Chevy Colorado Will Debut In Zr2 Off Road Form July 28 In 2022 Chevrolet Colorado Chevy Colorado Chevrolet

Genesis Gv60 Car Pictures G V Genesis

Genesis Gv60 New Cars Genesis Luxury Suv

Tesla Roadster 2020 Electric Blue With Interior And Chassis Tesla Roadster Tesla Roadsters

Should Congress Lift The 200 000 Sales Ev Tax Credit Cap Cleantechnica

What The Inflation Reduction Act Means For Electric Vehicles Union Of Concerned Scientists

Solar Investment Tax Credit To Be Extended 10 Years At 30 Pv Magazine Usa In 2022 Tax Credits Credit Score Investing

/cloudfront-us-east-2.images.arcpublishing.com/reuters/56X7K3DYDZLTHHHY3BTCEFESKI.jpg)

Electric Automakers Make Last Ditch Plea For More Tax Credits Before U S Election Reuters

Electric Vehicle Incentives Plug N Drive

Electric Vehicle Incentives Plug N Drive

Toyota Used Up All Its Ev Tax Credits On Hybrids Techcrunch

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

What To Know About The Electric Vehicle Tax Credits And How To Get More Money Back Wsj

Ev Tax Credit Extension With 7 500 Point Of Sale Rebate 4 000 For Used Evs Could Pass Senate Soon

Genesis Gv60 In 2022 Car Experience Genesis Luxury Suv

What To Know About The Complicated Tax Credit For Electric Cars Npr